Why is everyone talking about the RBI these days?

It’s not just headlines – it’s numbers that matter.

In 2025, the Reserve Bank of India repeatedly cut its policy repo rate – the rate at which banks borrow from the central bank, from 6.50% down to 5.25% by December. That’s a cumulative cut of 125 basis points (1.25%) in one year.

This reduction comes at a time when inflation is unusually low, even near multi-year lows in late 2025 and GDP growth is holding up strongly.

The big question is:

What Happens When Rates Fall?

Imagine you hold ₹1,00,000.

Where would you park it?

- A bank FD yielding 6-7%?

- A bond yielding 6%?

- A real world asset you hope will grow at 10-15%?

As traditional fixed-income returns compress (thanks to rate cuts), investors start looking for assets with intrinsic value and higher returns.

Land – long seen as illiquid and speculative – starts to look interesting again.

Real Estate Back in the Spotlight

Lower interest rates make borrowing cheaper. As of mid-2025, many banks cut home loan rates- with some lenders offering home loans under 7.3-8% for eligible borrowers as repo rates fell.

Cheaper loans improve affordability, which raises demand for real property. That, in turn, supports price appreciation.

It’s no coincidence that the All-India House Price Index rose by more than 3% year-on-year as real estate demand held up even before the latest rate cut.

The economics behind Financing:

Theory of Fructification

The Theory of Fructification says that asset value comes from the present value of future income it can generate.

When interest rates fall:

Future income gets discounted at a lower rate

Present value of the asset goes higher

That’s why land and property which don’t generate immediate cash flows like stocks or bonds but offer future payoff (rent, development gains, resale value) become more attractive.

Empirical Examples: Has this actually happened before?

1. United States (Early 2000s)

In the early 2000s, the US saw a dramatic shift in interest rates – the Fed cut aggressively after the dot-com downturn.

During 2001–2005:

- US home prices rose solidly – for example, average home prices expanded by double digits in many states by mid-2005.

- Nationwide housing price indexes show steady increases over these years.

Lower borrowing costs helped fuel demand and price growth, even before the later housing bubble dynamics fully took hold.

But apart from the Housing bubble which is highly unlikely due to changing economic dynamics(.

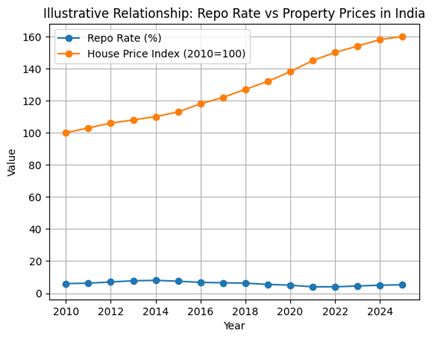

2. India (Post-2010 Interest Environment)

India’s policy rate history shows that in 2010, the repo rate was about 6.00% significantly higher than today’s 5.25%.

From 2010 to the mid-2020s, real residential property prices (housing price index) climbed from a base of 100 in 2010 to over 160 by 2025, roughly a 60% increase over 15 years.

That’s consistent with a period where interest rates were broadly trending down over the long term and capital increasingly sought real assets as low-cost borrowing persisted.

If the cost of money falls,

→ Do you prefer cash sitting in low-yield accounts,

→ Or real assets that may grow in value?

- Today’s repo rate is lower than most of the past 25 years.

- Home loan costs have come down.

- Residential and land prices continue to rise in many regions.

That’s not luck, it’s the result of capital reallocating toward real assets.

Conclusion: What Does This Mean for India Now?

India’s market is in a transformationary phase.

A sustained fall in policy rates has begun channelising excess liquidity into tangible, intrinsically valuable assets like land and real estate.

This is the essence of what we call the “financialisation of land” land moving from being a passive, often illiquid store of value into an investable financial asset class with clearer pricing, broader participation, and stronger upward potential.

In a world where traditional yields are compressing, real assets – especially land – are poised not just to survive but to thrive.

This shift also explains the emergence of platforms like RealX.

As land undergoes financialisation, the challenge is no longer belief – it is access, structure and transparency. RealX operates at this intersection, enabling real-world land assets to be structured, fractionalised, and evaluated through a financial lens, while remaining rooted in intrinsic value.

With a strong interest in markets and emerging financial infrastructure, I’m driven by how thoughtful design and disciplined decision-making can create lasting value. My work centres on creating robust financial frameworks that balance innovation with stability and long-term impact. I believe the best outcomes come from patience, clarity and long-term thinking.