I came across an advertisement today that said:

“In times of volatility, stable returns are the most precious.”

A reasonable line. But it made me pause.

Is stability valuable only when everything else is shaking?

Most investors instinctively chase high returns, especially in bullish phases. After all, monetary returns don’t exhibit diminishing marginal utility – every extra rupee still compounds, still accelerates and rewards. But compounding does not only work best when markets are euphoric or fearful – it also works best when growth is stable.

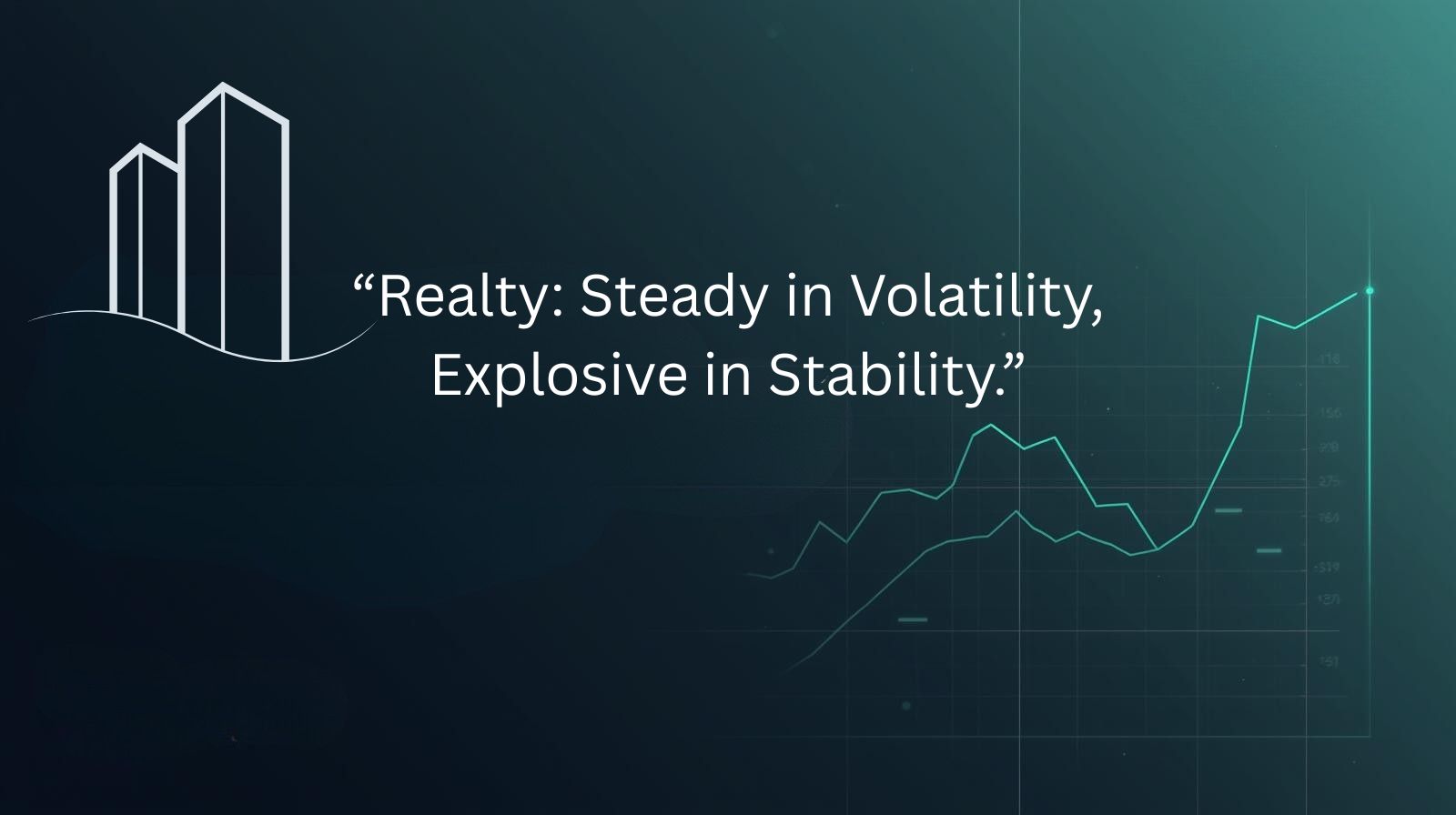

To understand this difference, it helps to look at the two contrasting indicators in the Indian market: India VIX and the Nifty Realty Index.

The India VIX, often called the fear gauge, measures expected market volatility over the next 30 days, derived from NIFTY 50 options. A high VIX signals anxiety, uncertainty and anticipation of wide price swings. A low VIX reflects calmness and confidence.

On the other hand, the Nifty Realty Index captures the performance of major real estate and construction development companies listed on the NSE. It represents a basket of stable, asset-backed businesses whose cycles move differently from high-beta sectors.

When we compare these two,

Trading view

The contrast is striking!

In periods where the VIX was elevated – such as 2021 to mid-2022 – the Realty index did not experience major collapses; instead, it moved sideways with only mild pullbacks, showing that the sector absorbs uncertainty better than high-beta segments of the market. Realty companies, backed by tangible assets and long-duration cash flows, tend to hold their value even when sentiment turns volatile. But the moment volatility starts easing – visible from late 2022 onward – the same stability becomes a powerful accelerator. As India VIX trended down over 2023 – 2025, the Realty index didn’t just recover; it multiplied, entering a steep and sustained rally that ultimately delivered nearly 200% returns. The brief VIX spikes in mid-2023 and mid-2024 caused only temporary pauses, not structural damage, reinforcing that volatility dampens momentum but does not derail the sector. Meanwhile, stable market conditions allow Realty to unlock its full return potential. In essence, the chart shows that Realty protects capital in uncertainty and compounds aggressively in calm conditions – exhibiting both defensive strength and outsized long-term growth.

This isn’t a coincidence. It’s market math.

Think of it this way:

When markets roar upward, everyone celebrates returns. But volatility beneath those returns creates drawdowns, emotional decision-making and inconsistent compounding. Stable assets avoid this churn. They keep adding, accumulating and building – even when headlines scream uncertainty.

Volatility highlights the importance of stable assets – Like Real estate and which maximizes the potential of your returns – in chaos, in calm and everywhere in between.

And this is exactly where platforms like RealX fit into the picture. RealX creates accessible smaller, fractional units, so the same stability that protects capital and compounds in calm markets becomes available to a wider set of investors.

Instead of committing large sums to a single property, an investor can diversify across multiple high-quality, income-generating assets – each backed by real-world value, each designed to behave exactly like the “steady compounding engine” the charts point toward. In periods of high volatility, such fractionalised real estate helps smooth portfolio swings; when volatility drops, the same assets participate in long, structural uptrends without the noise of daily market sentiment.

In simple terms, if your long-term strategy is to reduce volatility and enhance consistent compounding, allocating a portion of your portfolio through RealX is a rational, data-aligned approach.

With a strong interest in markets and emerging financial infrastructure, I’m driven by how thoughtful design and disciplined decision-making can create lasting value. My work centres on creating robust financial frameworks that balance innovation with stability and long-term impact. I believe the best outcomes come from patience, clarity and long-term thinking.